VCIF & REIF

What is a Venture Capital Investment Fund?

It is an unincorporated asset that is established for a period of time by portfolio management companies and venture capital portfolio management companies in order to operate the portfolio consisting of assets and transactions determined by the Capital Markets Board (Board) with the money collected from qualified investors in return for their participation shares, in accordance with the principles of fiduciary ownership on behalf of the shareholders.

It is an unincorporated asset that is established for a period of time by portfolio management companies and venture capital portfolio management companies in order to operate the portfolio consisting of assets and transactions determined by the Capital Markets Board (Board) with the money collected from qualified investors in return for their participation shares, in accordance with the principles of fiduciary ownership on behalf of the shareholders.

Why Venture Capital Investment Fund? (VCIF)

Tax advantage for the benefit of both the fund and the investor

Tax advantage for the benefit of both the fund and the investor- Opportunity to find partners without losing management control through fund shares

- Easy liquidity facility

- Opportunity to be traded on the stock exchange among qualified investors

- Easy capital raising through securitizationimkanı

- Opportunity to receive fund participation in return for capital in kind

- Transparency and accountability

Who Can Invest in Venture Capital Investment Fund?

All Qualified Investors with Domestic and Foreign Legal and Real Entities,

All Qualified Investors with Domestic and Foreign Legal and Real Entities,- Private Pension System Companies,

- Pension Mutual Funds,

- Foundations, Associations, Unions, Universities,

- The Company, which is a part of Technopark,

- R&D Firms,

- Foreign Banks and Financial Institutions

Can invest by receiving Participation Share from Venture Capital Investment Fund.

What are the Tax Advantages of the Venture Capital Investment Fund?

The VCIF investment model in our country has been designed in accordance with international norms in every respect and in a very flexible way, and it has been supported by very important tax incentives.

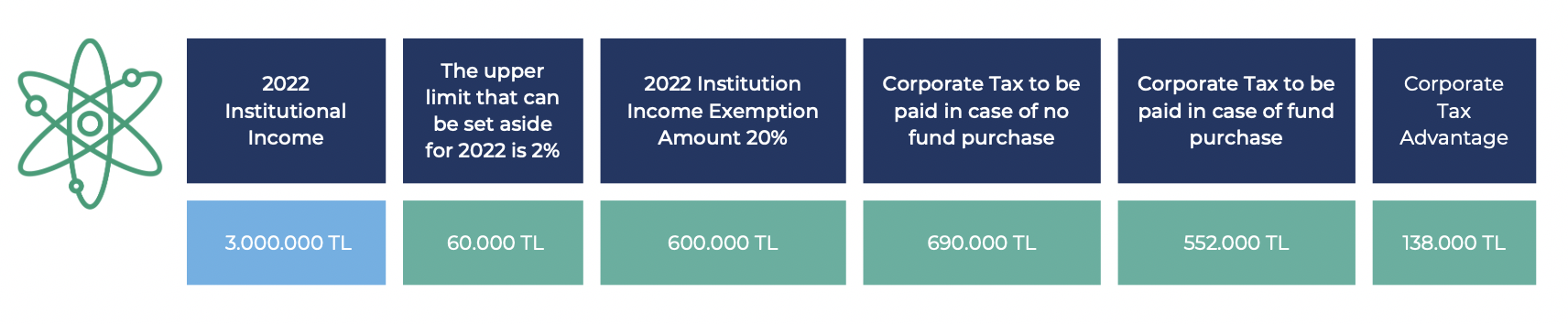

Example of Discount Amount to be Made pursuant to Article 10/1-g of the Corporate Tax Law:

The maximum amount of funds that can be allocated for the Venture Capital Fund in 2022 is 280.000 TL.

Assuming that a fund of 150,000 TL has been allocated for the year 2022, the entire amount of this amount can be deducted from the corporate tax base.

In this case, 34.500 TL (23% Corporate Tax Rate) less tax will be paid.

As long as this 150.000.000 TL fund is used in VCIF investments, taxes will be deferred.

(Time value of money) With no interest or penalty when exiting VCIF investments after 10 years.

The tax of 150.000 TL, which was subject to the tax base reduction 10 years ago, will be taxed at the rate of that year.

In addition to the benefit obtained from the deferred tax payment due to the inflation effect, additional income will be obtained from the investments to be made with the said 34.500.000 TL.

R&D Discount Sample Taxation Calculation

It is obligatory for companies with R&D discount amount exceeding 1 Million TL to allocate 2% of their earnings subject to exemption and deduction as a fund and to use this fund for the purchase of Venture Capital Investment Fund Participation Certificate or for investing in venture capital investment partners as capital.

In this context, the amount obligation to be transferred is limited to 20.000.000TL on an annual basis.

Advantages of VCIFs Over Real Estate Investment

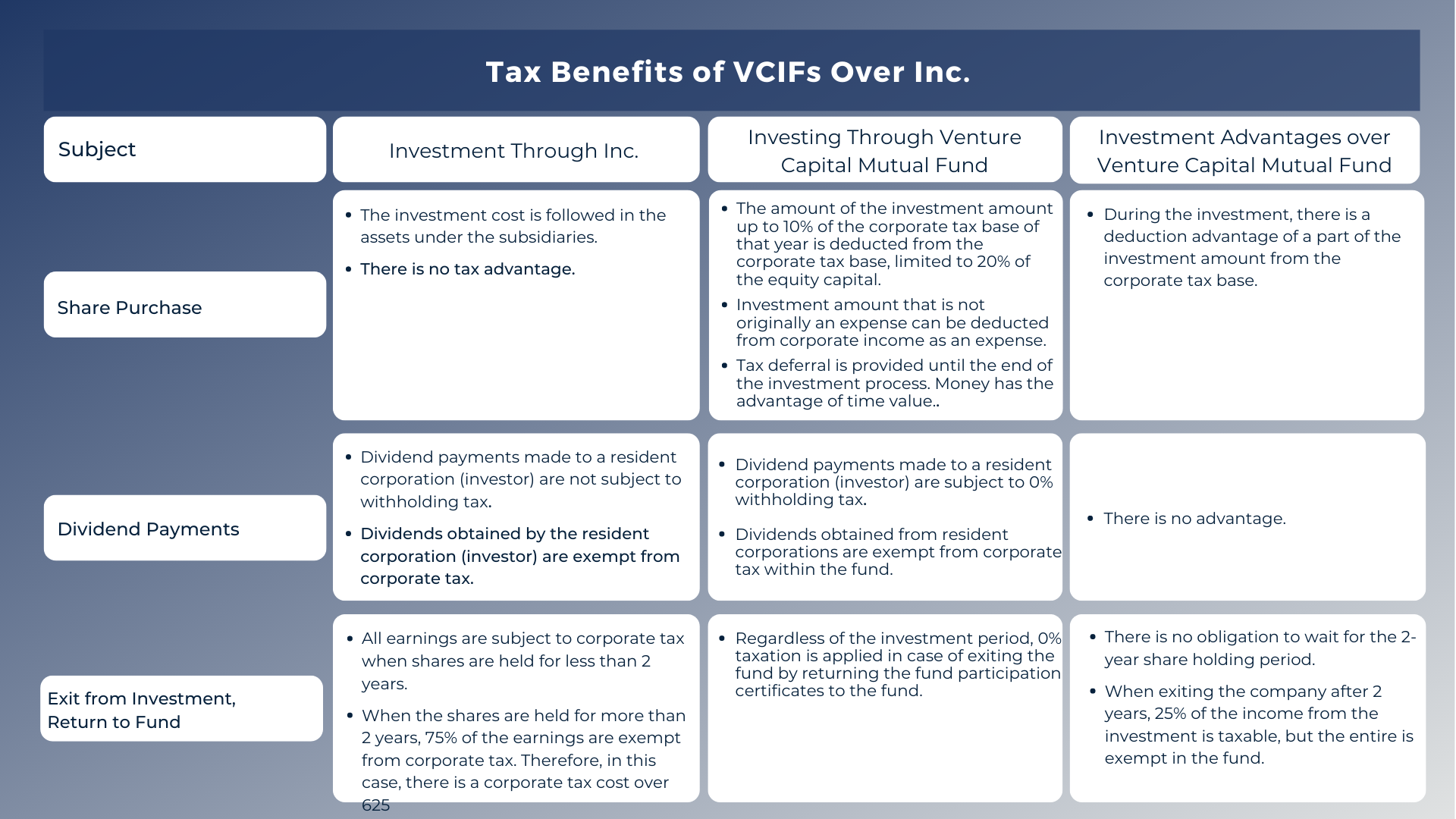

Tax Benefits of VCIFs Over Inc.

Tax Reductions and Incentives for Investors in VCIFs and REIFs

Along with the "LAW ON TECHNOLOGY DEVELOPMENT ZONES AND THE LAW ON CHANGE IN SOME LAWS", which entered into force after being published in the Official Gazette on February 3, 2021; Venture Capital Investment Trusts, 2% of the exempt earnings or R&D (design) discounts they have benefited from entrepreneur companies operating in Technology Development Zones and R&D/Design Centers carrying out on-site R&D/design activities within the scope of Law No. 5746, It is obligatory to invest in incubation centers operating in Venture Capital Investment Funds or TDZs.

What Is the oblIgatIon of taxpayers benefItIng from the R&D / DesIgn dIscount and taxpayers In the Technology and Development regIon to Invest In Venture CapItal?

What Is the oblIgatIon of taxpayers benefItIng from the R&D / DesIgn dIscount and taxpayers In the Technology and Development regIon to Invest In Venture CapItal?

Important tax adjustments were made in the Law No. 7263 on Technology Development Zones and the Law No. 4691 on Technology Development Zones and the Law No. 5746 on Supporting Research, Development and Design Activities, published in the Official Gazette dated February 3, 2021 and numbered 31384.

Law No. 4691, ADDITIONAL ARTICLE 3

Law No. 4691, ADDITIONAL ARTICLE 3

- Effective as of 01.01.2022, within the scope of Temporary Article 2, by taxpayers whose earnings amount is 1,000,000 TL or more, which are exempted on the annual declaration, 2% of the amount subject to the exemption is followed in a temporary account in liabilities and until the end of the year in which this account is created, it has been stipulated that it be transferred to entrepreneurial companies by one of the methods determined within the scope of this law.

- The annual upper limit for the investment has been determined as 20.000 000 TL

- If no investment is made, 20% of the earnings will be subject to corporate tax.

R&D DIscount

R&D DIscount

Paragraph 14 of Article 3 of the Law No. 5746 on Supporting Research, Development, Design and Activities:

- As of 1/1/2022, 2% of this amount is transferred to a temporary account in liabilities by corporate taxpayers whose annual tax return (R&D Discount) amount is 1,000,000 TL or more within the scope of Article 3.

- The amount liability to be transferred within the scope of this paragraph is limited to TL 20.000.000 on an annual basis.

- Until the end of the year in which the temporary account is formed, it is obligatory to purchase the shares of venture capital investment funds established to invest in entrepreneurs residing in Turkey, or to invest in venture capital investment trusts or entrepreneurs operating in incubation centers within the scope of Law No. 4691.

- If this amount is not transferred until the end of the relevant year, 20% of the amount deducted from the annual declaration within the scope of this law cannot be subject to the R&D discount utilized in the relevant year.

Taxes that are not collected on time due to this amount are levied without applying a tax loss penalty.

Incentive Programs for VCIFs and REIFs

TUBITAK 1514 Tech-Investr

TUBITAK 1514 Tech-Investr

VCIF investments are also encouraged by TUBITAK.

With the Tech-InvesTR Venture Capital Support Program, SME-scale early-stage technology-based companies that can add value to the country's economy, with the aim of providing the capital they will need in the commercialization processes of their products and technologies resulting from their R&D and innovation activities, through venture capital funds it is aimed to support Transfer Offices, Technology Development Zones and Research Infrastructures for which competency decision has been made, on a non-refundable (grant) basis.

Pursuant to article 2, subparagraph (e) of the TUBITAK Establishment Law No. 278, the main duty of TUBITAK is to develop and implement incentive and support systems that will ensure the effective participation of the public and private sectors in technological research, development and innovation activities; To support legal entities and funds operating for the commercialization of inventions with early development potential. In addition, for this purpose, to establish a company upon the approval of the relevant Minister, to have privileged shares in established companies; to support the transformation of the outputs of the public and private sectors as a result of research, development and innovation activities into commercial value; To develop programs that will enable the industry to cooperate with universities and research institutions and organizations and to create environments where this cooperation can become concrete.

PensIon Investment Funds

OKS Standard Fund, which is a type of pension mutual fund, is the standard fund in which the savings of employees included in the private pension system are invested through employers within the scope of Annex-2 and Temporary Article 2 of the Private Pension Savings and Investment System Law No. 4632.

A minimum of 10% of the OKS Standard Fund portfolio is invested in;

- Venture capital investment fund participation shares,

- Real estate investment fund participation shares,

- Turkey Wealth Fund and/or capital market instruments issued by companies established for the purpose of investing in infrastructure projects,

- and other capital market instruments deemed appropriate by the Board.

The amount directed to venture capital mutual fund participation shares cannot be less than 1% of the total OKS Standard Fund Portfolio.

Istanbul Development Agency

Istanbul Development Agency

Programs supporting VCIFs are organized by the Istanbul Development Agency (ISTKA).

Regional Venture Capital Financial Support Program

➤ Applications can be made for funds established or to be established in the program.

➤ Funds that have received support from TUBITAK and the Ministry of Treasury and Finance can also participate in this program.

► The allocated program budget for 2021 is 250.000.000 TL in total.

➤ It was decided to invest in a total of 17 Funds.

Buying and Selling Funds Based on Real Estate

Buying and Selling Funds Based on Real Estate

Goldeo Turkey is in contact with domestically based real estate portfolio companies.

Based on the demand, it is possible to create a complete project from the portfolios of these companies as well as a mixed basket of different projects.

Investors will be able to earn an additional profit from real estate value increases over the years, in addition to earning a profit by issuing lease certificates by keeping the real estates acquired from these portfolio companies in the same company.

The minimum value required is $ 500,000 to obtain Turkish citizenship through Buying and Selling Real Estate Based Funds.

Buying and Selling Funds Based on Money Market

Goldeo Turkey can carry out money market-based fund buying and selling transactions in the presence of a bank it is in contact with, an investment account opened in the name of the investor at this bank and an investment advisor.

On the occasion of this transaction, the amount required to be deposited in a domestic bank for citizenship can be traded in the investment account, and may generate additional investment-based earnings.

To obtain Turkish citizenship with the purchase of funds, the minimum investment required is $ 500,000.

Sukuk

With the participation bank in which Goldeo Turkey is in contact, Goldeo Turkey can manage the lease certificate (sukuk) purchase process on behalf of the investor.

The masses, who earn an interest-free income with the acquisition of sukuk, may have acted in accordance with the procedure in an Islamic way.

To obtain Turkish citizenship with the purchase of funds, the minimum investment required is $ 500,000.